Learnings from the decade (2010-2020)

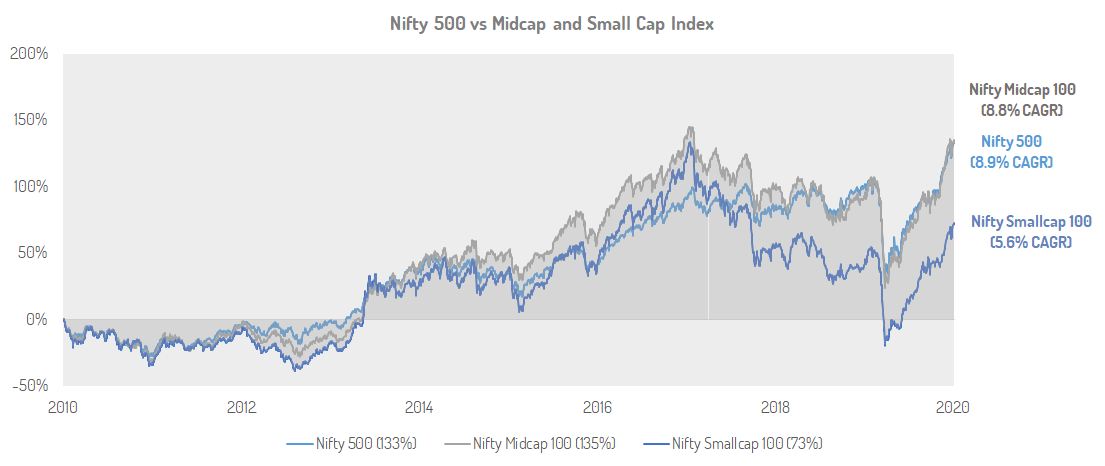

Index performance in the last decade 2010-2020

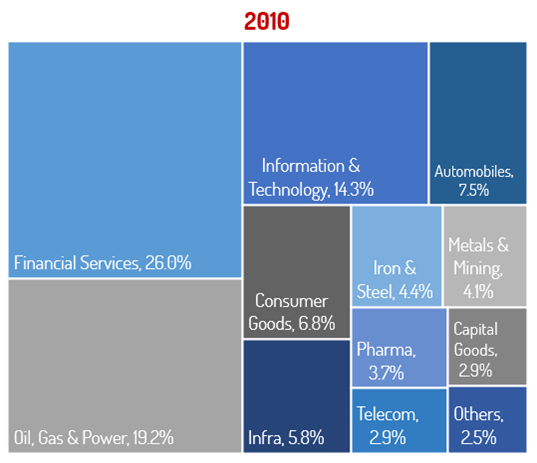

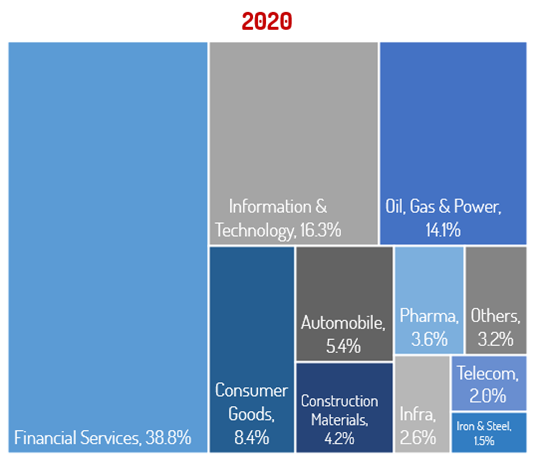

Nifty 50 - Then v/s Now

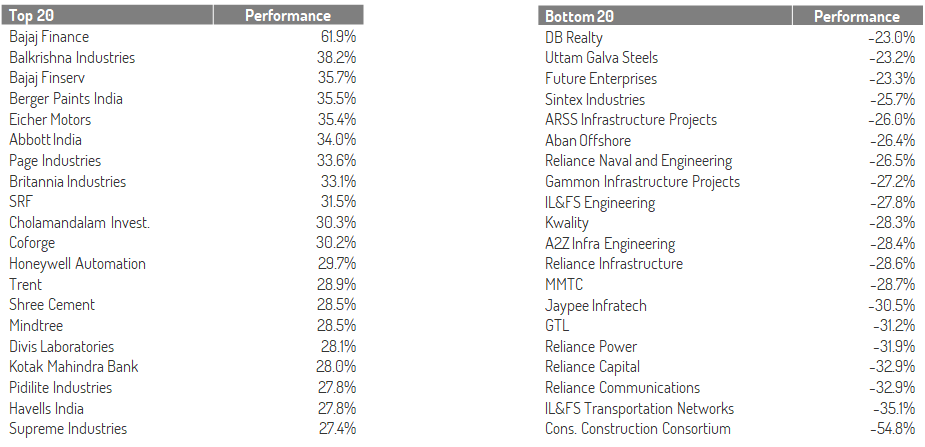

Top 20 performers & Bottom 20 performers of the decade – 10 year CAGR

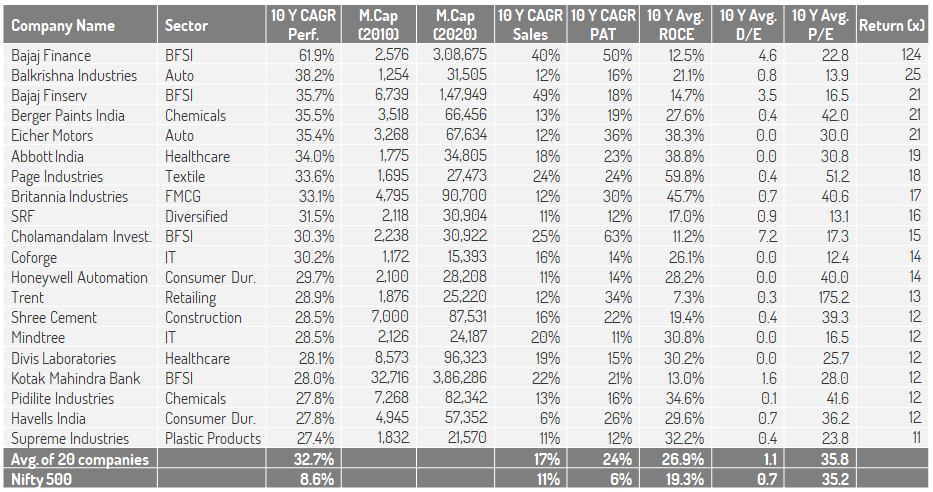

Top 20 Performers of the decade (2010-2020)

Most of the Top 20 Performers belonged to non-cyclical sectors such as Banking, Financial services and Insurance (BFSI), Automobiles and Healthcare.

Debt to Equity was slightly higher than the benchmark’s 0.7 due to the inclusion of financial companies like Bajaj Finance, Bajaj Finserv & Cholamandalam Investment.

Note: Nifty 500 Performance based on 10 Year M.Cap CAGR, Ignored 90 companies for this case study that have either been acquired/merged/gone into bankruptcy during the decade

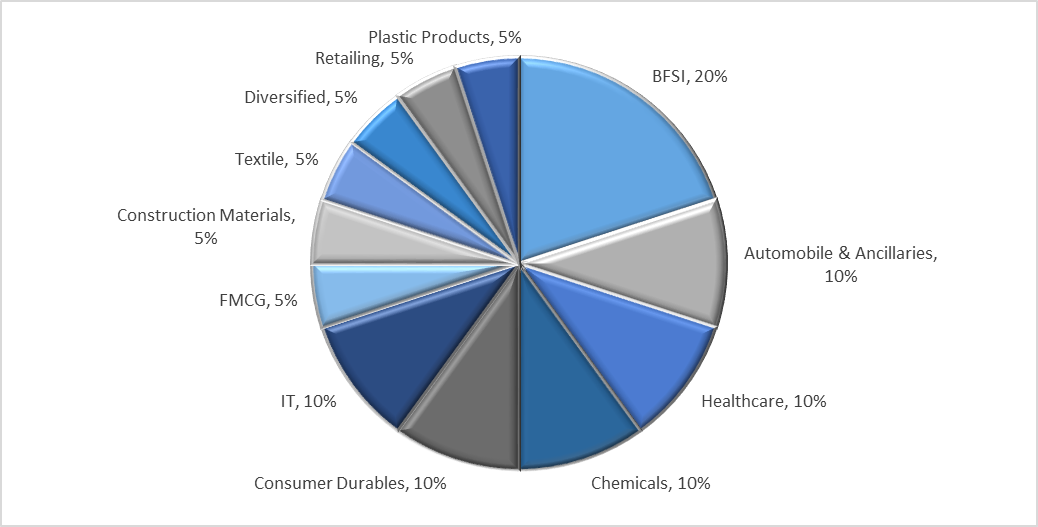

Top 20 performers by sector composition

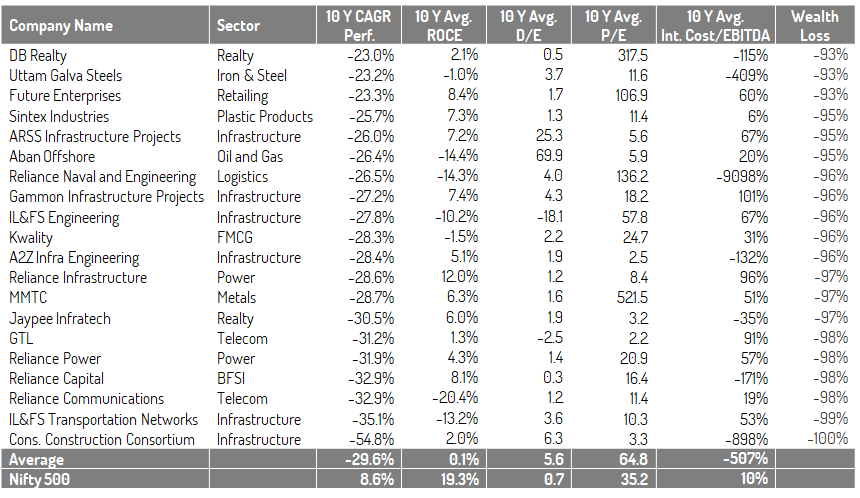

Bottom 20 performers - Fundamentals

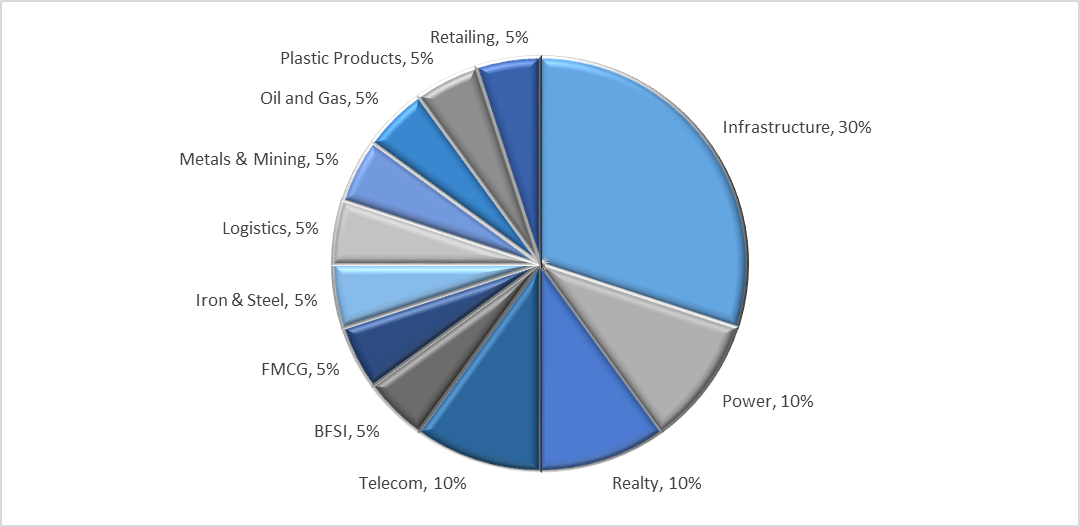

Most of the Bottom 20 Performers belonged to cyclical sectors such as Infrastructure, Power, Realty and Telecom.

Many became loss making at the EBITDA levels, with high interest costs adding to their burden.

Due to the high amount of working capital required in these sectors, a poor cycle impacts the business dearly making them unable to pay off the debts.

Bottom 20 performers by sector composition

Learnings from the decade (2010-2020)

- Leave penny for the traders, focus on the pounds!

- Believe in the long term story of the company / industry

- Focus on 4 P’s: Promoter, Product, Profit and Price

- With no debt, it’s near impossible for you to go bankrupt!

- Watch out for the market / industry cycles

- Growth Investing v/s Value Investing: Pick your battles wisely

- India’s consumer behaviour can tell you more market sentiments than any brokerage report

- No replacement for “Patience”: Investing is an ultra-marathon – not sprint

- Understand how Entrepreneurs are redefining products & demand. Focus on emerging ideas, industries & products.

- Chase winners instead of catching falling knives

- Good company is not always a great investment

- Economics is not equal Investments

- QUALITY - QUALITY - QUALITY!!!