Three things you look in a company before investing – Growth, Growth & Growth

At Pi Square, the stocks we select show a major percentage increase in the current quarterly earnings per share (the most recently reported quarter) when compared to prior year’s same quarter. Historically, we have always seen that prices are slaves to earnings. From 1990 to 2012 most of the very best performers in Indian Equity markets showed earnings gaining from 30% to 100% before their big price moves. So, if the best stocks had profit increases of this magnitude before they advanced rapidly in price, why should you settle for anything less? You may find that only 5% of listed stocks will show earnings gains on this size. But remember, you are looking for stocks that are exceptional, not lacklustre. Don’t worry they are out there.

The EPS is the single most important element in the stock selection today. The greater the percentage increase, the better.

We are amazed at how some professional money managers, let alone individual investors, buy equity when the current reported earnings are flat or even negative. There is absolutely no good reason for a stock to go anywhere in a big, sustainable way if its current earnings are poor. It’s not only quarterly EPS growth but consistent earnings growth and improving margins which shows efficiency of top management. Look for top players in each segment, showing consistent growth and still priced at reasonable valuations.

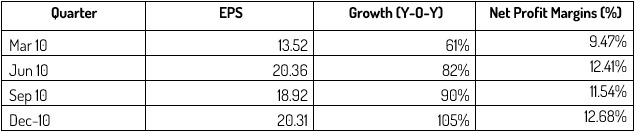

In February 2011, we analysed FAG Bearings, second largest bearings manufacturer in India. It was valued at INR 795.00 on February 3, 2011. This is how last 4 quarters EPS numbers looked like.

At these levels in March 2011, FAG Bearings was priced at P/E of 10.00 and ROCE (Return on Capital Employed) of 31.60. Consistent growth, improving net margins and cheap valuations – FAG Bearings became a core holding for Pi Square Portfolio. Below is the chart of FAG Bearings from February 2011 to February 2012.

In 12 months ending February 2012 FAG Bearings produced 76% returns compared to -8% by NIFTY (Index Returns). FAG Bearings is a 100% debt free company with second largest market share in Bearings Industry. FAG Germany owns 56% of total issued share capital of Indian subsidiary. In March 2009, FAG Bearings was priced at INR 277.00 (produced more than 500% return in just 3 years).

As a retail Investor, keep your research simple and look for good valuations around you. Equity Investing will always reward a magical combination of growth and valuations. Don’t fall in trap of low book value or low P/E numbers – these are just numerical numbers without mix of business cycle or growth story attached.