Introduction: Some patterns and events recur regularly in our environment, influencing our behaviour and our lives. This can be seen in various instances throughout our planning schedules and routines – from planning our holidays based on the seasonal cycle to planning our work, recreation and sleep based on the regular day cycle. We depend on …

Author Archives: pisquare

Investing and Cricket

World of investing is like test cricket. Both require specific style, temperament, homework to be successful Cricket is India’s favourite pastime. Find yourself in a café or one of the many tea stalls that line the road on a match day and you’ll invariably get a ball by ball analysis of the match and how …

Learnings from the decade (2010-2020)

Index performance in the last decade 2010-2020 Nifty 50 – Then v/s Now Top 20 performers & Bottom 20 performers of the decade – 10 year CAGR Note: Nifty 500 Performance based on 10 Year M.Cap CAGR, Ignored 90 companies for this case study that have either been acquired/merged/gone into bankruptcy during the decade Top …

Three things you look in a company before investing – Growth, Growth & Growth

At Pi Square, the stocks we select show a major percentage increase in the current quarterly earnings per share (the most recently reported quarter) when compared to prior year’s same quarter. Historically, we have always seen that prices are slaves to earnings. From 1990 to 2012 most of the very best performers in Indian Equity …

Continue reading “Three things you look in a company before investing – Growth, Growth & Growth”

Indian Equities 30% in 33 days. Seen it before?

Indian markets have started outperforming not only developed markets but also emerging markets in the correction phase. Indian Equities in local currencies has provided 20% in first 5 weeks and 30% in currency adjusted terms. Next question on every investors mind is “30% in 33 days! Seen it before?” Actually Yes. This rally – 33 …

Continue reading “Indian Equities 30% in 33 days. Seen it before?”

Equities or Debt?

The fact that debt instruments have beaten equities in the developed markets, like the US, in the recent past, as well as over longer time frames of say 30 years only increases the scare if a similar situation could occur in India as well. If the trend in Indian equity markets doesn’t improve visibly from …

Global Challengers 2011

Earlier this year BCG (Boston Consulting Group) came up with BCG Global Challengers 100 list, rising stars from rapidly developing economies are reshaping global industries. The 2011 global challengers are a diverse group, reflecting the dynamic nature of global competition. The list came from 16 countries, with China, India, Russia, Brazil, and Mexico dominating the …

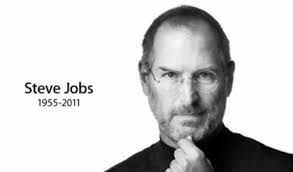

Steve Jobs – Visionary, Inventor, Leader and above all the greatest entrepreneur

In India, we find it difficult to replicate Facebook, Google or Apple business models where inherited entrepreneurship and wealth accumulation works against product innovation and long term sustainability. Even at “Local Innovation” Infosys or Tata Nano are still rare case-studies. Let’s introduce innovation or product valuation in financial valuation models. As Apple and Pixar’s example show, investing in …

Continue reading “Steve Jobs – Visionary, Inventor, Leader and above all the greatest entrepreneur”

Infrastructure or India-fractured?

“Grass is always greener on the other side” I think many young Indians will feel the same way who left India in early 2000’s to pursue career growth. I left India in YR 2002, an early stage of India’s growth story, as all the asset classes across India have multiplied 5x in nominal terms in …

The Good, the Bad & the Ugly

Over a dinner party last weekend, a friend of mine argued that the only way to invest in Indian equities is buying for long term. When I asked, define “long term”, he was clueless. Many Indian investors have burned their hands in trading equities and derivatives. Now a new born idea of SIP (Systematic Investment …