Three things you look in a company before investing – Growth, Growth & Growth

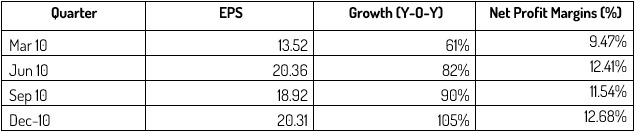

At these levels in March 2011, FAG Bearings was priced at P/E of 10.00 and ROCE (Return on Capital Employed) of 31.60. Consistent growth, improving net margins and cheap valuations – FAG Bearings became a core holding for Pi Square Portfolio. Below is the chart of FAG Bearings from February 2011 to February 2012.

In 12 months ending February 2012 FAG Bearings produced 76% returns compared to -8% by NIFTY (Index Returns). FAG Bearings is a 100% debt free company with second largest market share in Bearings Industry. FAG Germany owns 56% of total issued share capital of Indian subsidiary. In March 2009, FAG Bearings was priced at INR 277.00 (produced more than 500% return in just 3 years).

As a retail Investor, keep your research simple and look for good valuations around you. Equity Investing will always reward a magical combination of growth and valuations. Don’t fall in trap of low book value or low P/E numbers – these are just numerical numbers without mix of business cycle or growth story attached.