Indian Equities 30% in 33 days. Seen it before?

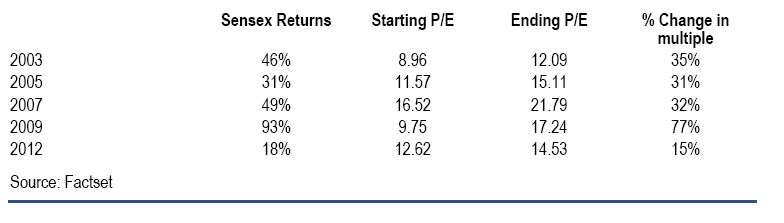

Indian markets have started outperforming not only developed markets but also emerging markets in the correction phase. Indian Equities in local currencies has provided 20% in first 5 weeks and 30% in currency adjusted terms. Next question on every investors mind is “30% in 33 days! Seen it before?” Actually Yes. This rally – 33 trading days so far, and currency adjusted – only makes the middle of the 5 big rallies in the last decade. Lot of fund managers explained 2011 as a minor correction in the long term bull phase.

So how is this rally different than rallies of the last decade?

- a) More broad-based (relative mid-cap/small cap performance is second best)

- b) Starting from a relatively higher valuation (1yr fwd PE: 12.6x – second highest; range: 9x-16.5x)

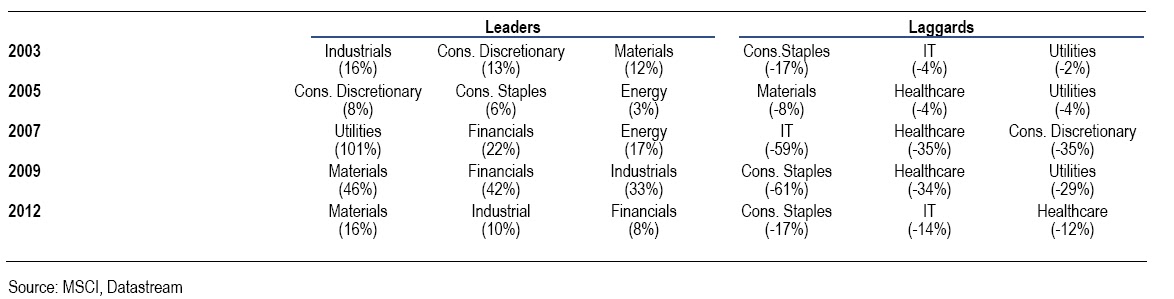

- c) Outperformance is led by the usual sector suspects (Materials: 16%, Industrials: 10%, Financials: 8% and as always

- d) has been led by strong foreign Inflows, though this time there has been aggressive domestic selling (almost 50% of foreign buying). Not enough to say its ‘different this time’, but there are differences.

Liquidity driven rally has pushed emerging markets to next level outperforming Developed Markets once again in the recovery phase. India has led the global equity market rally: up 30% in 33 days in USD terms, 20% in local currency terms, and tracked closely only by Brazil amongst the relatively large EM’s. It’s in part a bounce-back from a very poor 2011 (-38% in USD), but it is nonetheless a very strong bounce-back.

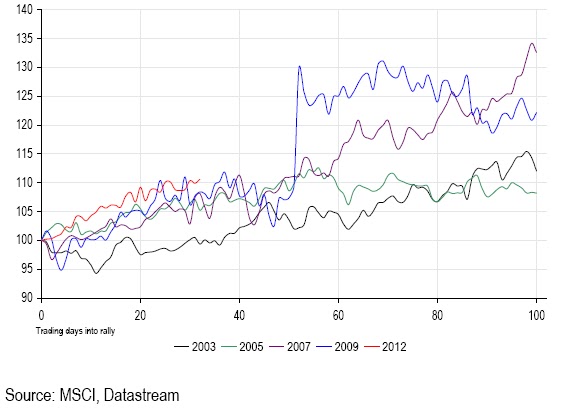

India’s performance relative to EM’s (in local currency) has tended to be more middle of the road in the early part of the rally (local currency): with India Underperforming EM’s in the 2003 rally, and outperforming in the 2009 rallies (the two big EM rallies – the other two were a little more India-centric. Its USD based performance this time though is stronger than any of the other rallies in the early part; and that India went on to out-perform at the 100-day mark of these rallies suggests a very strong start.

Will this out performance continue? We believe the jury is still out. In 2003, India was sitting on very low valuations and high operating leverage at the start of rally. And in 2009, valuations were a lot lower and while India did face a financing crisis economic momentum was only mildly interrupted by the slow down. This time, while the market’s start has been strong in absolute and relative terms; starting valuations are less compelling, and its economic outlook more tepid.

Leaders and laggards are pretty traditional:

Are the leaders and laggards very different this time? Not really: it’s the rate sensitives – Materials / Industrials/ Financials that drove the market. And it’s the traditional defensives – Consumers, IT and healthcare that make up the rear. We believe if the rally is to continue, then it will largely be these sectors that will lead, although materials will potentially be a little less predictable given the increasingly varied global driver. We also expect Consumer discretionary to potentially outperform going forward given their relative rate sensitivity and make more of a mark compared to the material sector.

Conclusion:

We do however choose to run some risk and at the market level, stick with what we believe is fair value for the Indian market. Which remains 19,400 for Dec2012, based on a March 13 PE multiple of 14.5X, a slight discount to the markets long term multiple of 16X. We recognize the market mood has changed, there is more capital that is available (and that is critical for a market / economy like India), and there is probably a little less caution with the corporate sector than two months ago. But not enough has changed on the ground in the broader economy, or the corporate sector. We argue that while the macro and the market have moved favourably – the economy/corporate sector have to play catch up, and deliver in earnings, investment, expansion and risk appetite. From liquidity rally, we will see a minor fundamental correction which will allow long terms investors to enter again with high risk – high reward ratio. India is still a long term growth story and as at heart majority of India is still living in villages, actual growth will be seen in small and mid-size corporate in next 4-5 years.