Equities or Debt?

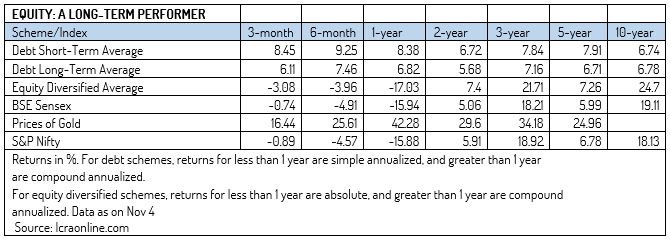

Retail equity investors always make a mistake of entering markets at the wrong time and exiting at even worse point. Equity Investors are not happy given current market conditions and many investors have given up on investing in equities all together. The average return given by the debt (short-term and long-term) fund category has been higher than those delivered by the Sensex, Nifty or the equity diversified fund category in the past three, six and twelve months. Alarmingly, even in the past two years, average returns delivered by equity diversified funds and key equity indices aren’t significantly different from those of debt funds. Given that equity is a relatively riskier asset class compared to debt, it is also expected to deliver better returns than the latter.

It is very subjective how you see long term equity returns. Value investors like Warren Buffet and Peter Lynch benefited from market corrections as they added majority of their portfolios when common investors were running away from the capital markets and valuations were attractive. If one manages his/her portfolio actively (shifting from equity to debt when markets are volatile or selling when markets are running above historical averages) it is very easy to secure 15-20% per year from equities. Warren Buffet has proved it over the years that fundamental investing can create life-time wealth for long-term investors.

Gold has been on an exceptional run for last few years outperforming every asset class. Gold has provided more than 24% p.a. for retail investors in last 5 years.

As we recently discussed with our research team, 2011 was the easiest and most predictable crash of recent times. Retail participation in equities has been very low in 2011 and very few fund managers have burned their hands this year with above average portfolio allocation. Pi Square financial advisors have been advising HNI Investors from start of the year to shift in debt and invest in equities below historical averages (post-August 2011). In short, the near-term outlook for the debt category looks good. But, if you are looking at equities with a longer-term horizon, of three years or more, this may not be a bad time to put in your money in bits and pieces.