Steve Jobs – Visionary, Inventor, Leader and above all the greatest entrepreneur

In India, we find it difficult to replicate Facebook, Google or Apple business models where inherited entrepreneurship and wealth accumulation works against product innovation and long term sustainability. Even at “Local Innovation” Infosys or Tata Nano are still rare case-studies. Let’s introduce innovation or product valuation in financial valuation models. As Apple and Pixar’s example show, investing in firms that have an innovation edge can generate returns few other investment styles can beat.

Steve Jobs will perhaps be best remembered for the innovative devices and industry-changing technologies he built as co-founder Apple Inc. Apart from his huge impact on the computing industry; the Silicon Valley entrepreneur has left an indelible mark on the entertainment and cell- phone industries. Besides, through the computer animation work of Pixar Animation Studios Inc., he has had a large influence on the movie-making business as well.

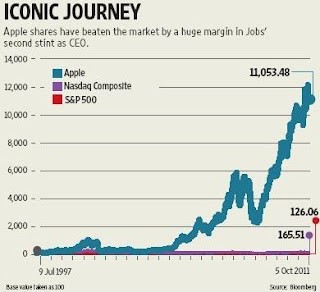

Steve Jobs, an entrepreneur taught Investors that product innovation and product placement is more important in the business world compared to quarterly financial success and wall-street views. Apple’s investors gained 17.25% since company’s initial public offer more than 31 years ago. While in his second innings Steve Jobs leadership and vision resulted in 39% annual average rate of return compared to 1.5% for S&P 500 Index. $10,000 invested with Apple from July 1997 would turn in to $1.1 million in October 2011 (10,000% return in 14 years)

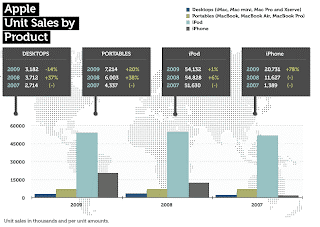

Apple not only redefined business case studies in management schools but also re-created history in product innovation. It’s an “ijourney” for Investors from iMacs to iTunes to iPods to iPhones to iPads. Today Apple is the world’s most valued company with fraction of sales compared to companies like ExxonMobil or Wal-Mart. Apple’s sales grew from $4 billion in Q4 2006 to $18 billion in Q4 2010 (4X in 4 years). Apple began selling iPhone in June 2007. Job’s goal was sell 10 million of them in 2008, equivalent of 1% of the global cellphone market. The company sold 11.6 million iPhones in 2008

My Apple investments introduced me to P.I (product innovation) ratio which I find much more important than commonly discussed P.E (Price Earning) ratio or D.C.F models (Discounted Cash Flow). Retail investors, looking for long term capital appreciation should look at leadership, product innovation, and product growth cycles. As Peter Lynch famously quoted “I find more investment opportunities in a shopping mall than on balance-sheets”. Look for next opportunities around you – in your shopping baskets, in malls, in banks, in movie-theatres.

In Financial valuations, we need to introduce product innovation premium. Let’s not judge a company based on P/E (Price/Earnings) or ROE (Return on Equity) alone. We need to understand leadership and products as a consumer before we invest our hard-earned money in capital markets. How many investors accumulated Apple shares when they bought their first iPod or iPhone? I was happy to off-load my Apple shares in 2009 with just 50% returns (loosing most of those gains in Mutual Funds in 2011). Investors need to evaluate his or her portfolio every quarter but I recommend that we allocate 10% of our funds to companies with strong brand recognition and product innovation.